My role and responsibilities:

- Senior UX Designer: ideation, strategy, UX/UI design, prototyping, cross-functional collaboration (tech, product, design systems, vendor, payments, legal/compliance)

- Research: generative research, usability research, competitive analysis

The customer problem:

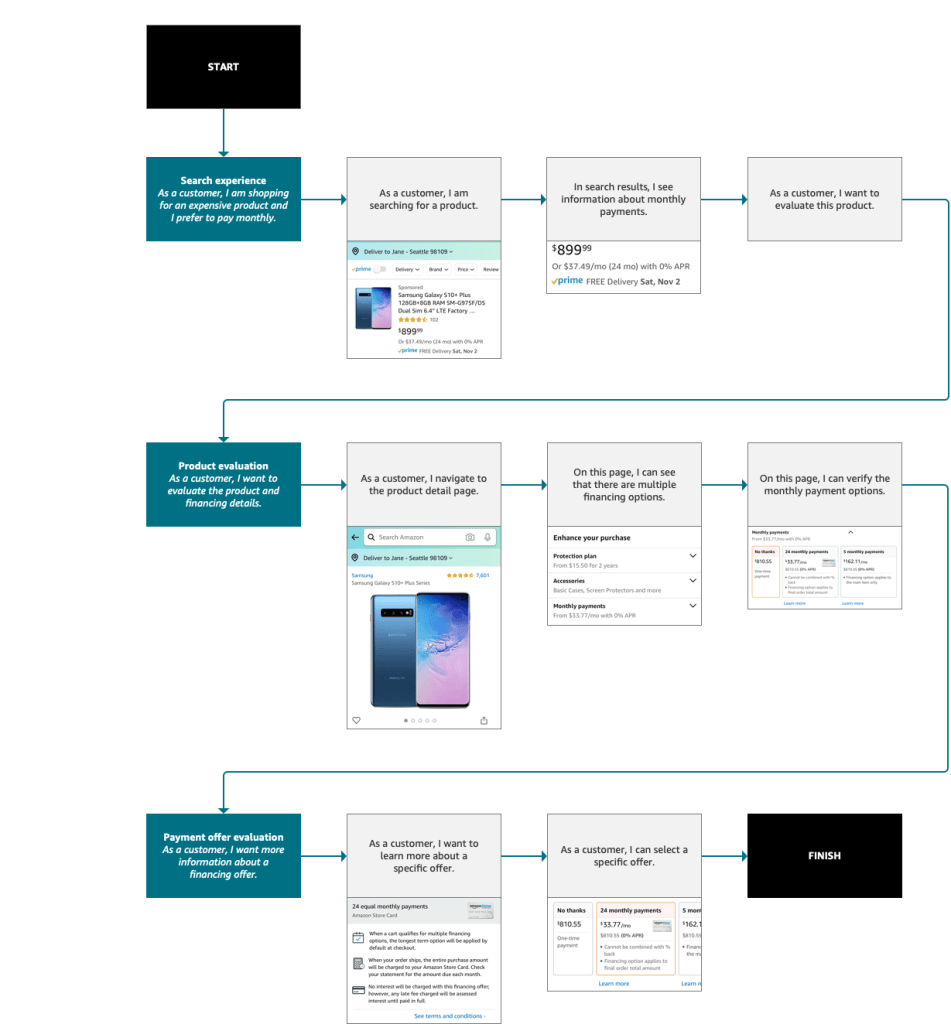

Customers face significant challenges navigating affordability and financing options during their shopping journey. Information about eligibility for financing programs is difficult to discover, and the criteria guiding eligibility are often unclear. Once customers become aware of financing, they are typically instructed to select it during checkout—but these instructions are hard to remember or locate, especially after a non-linear or interrupted shopping experience. Additionally, the complexity of financing terms and lack of concise messaging further hinder customers’ ability to make informed decisions with confidence.

My design process:

- Generative design research (on-site research lab in Denver)

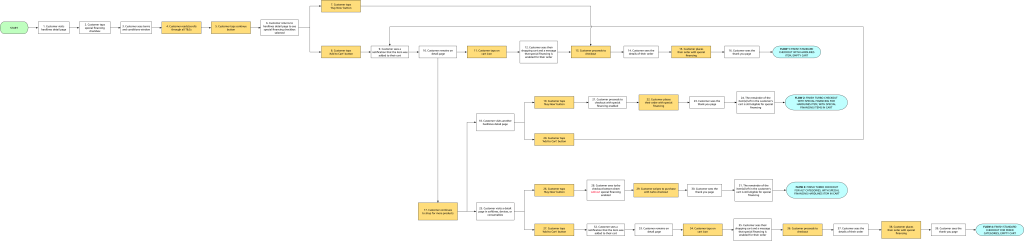

- Cross-functional workshops (virtual)

- Research meta-analysis

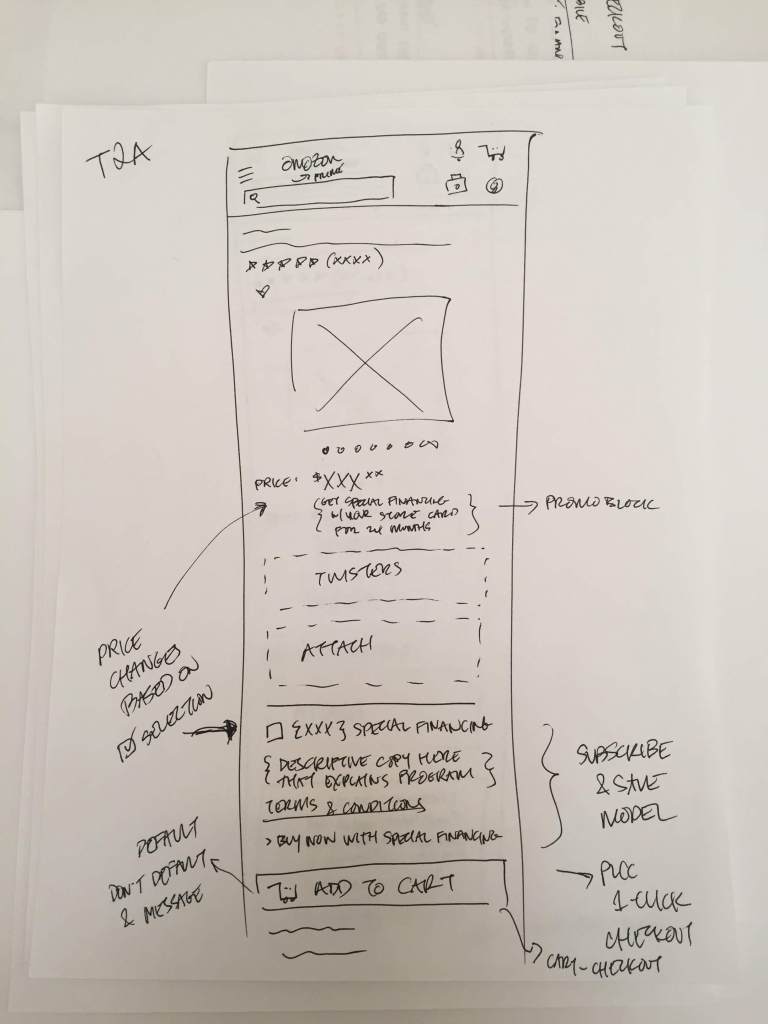

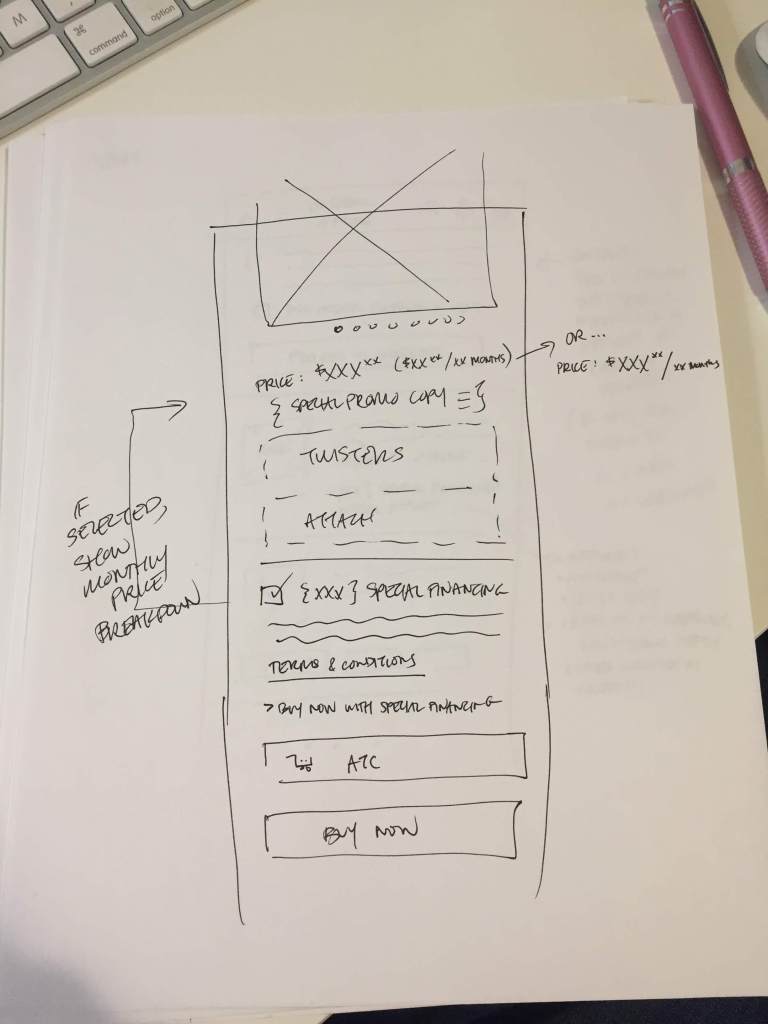

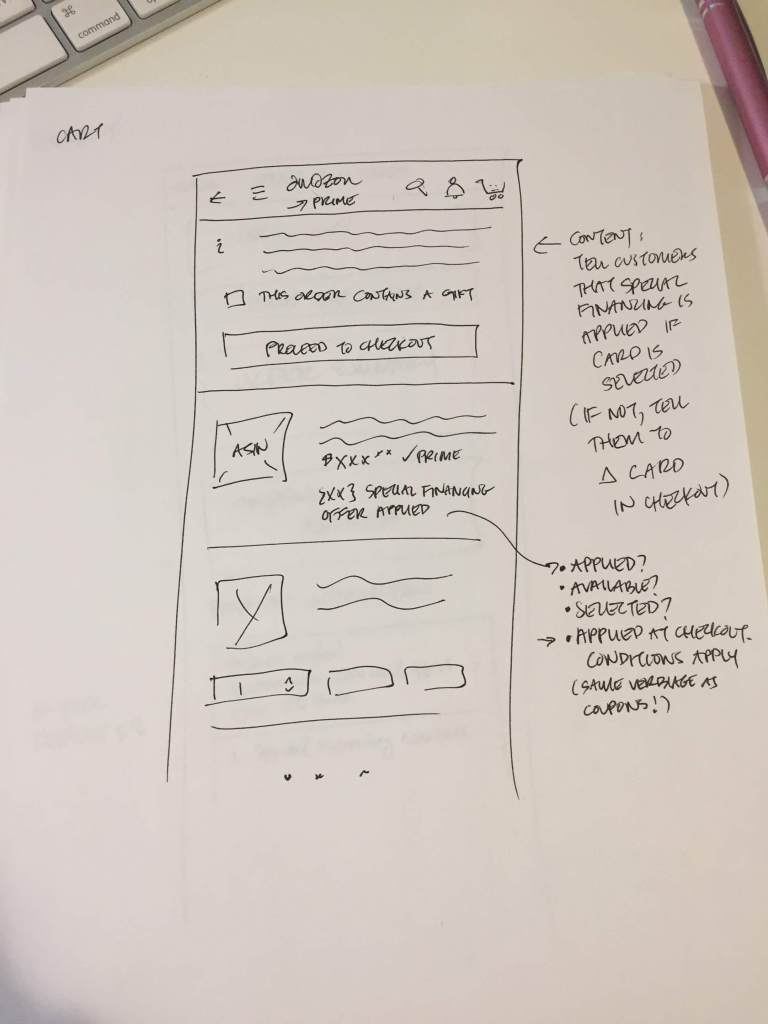

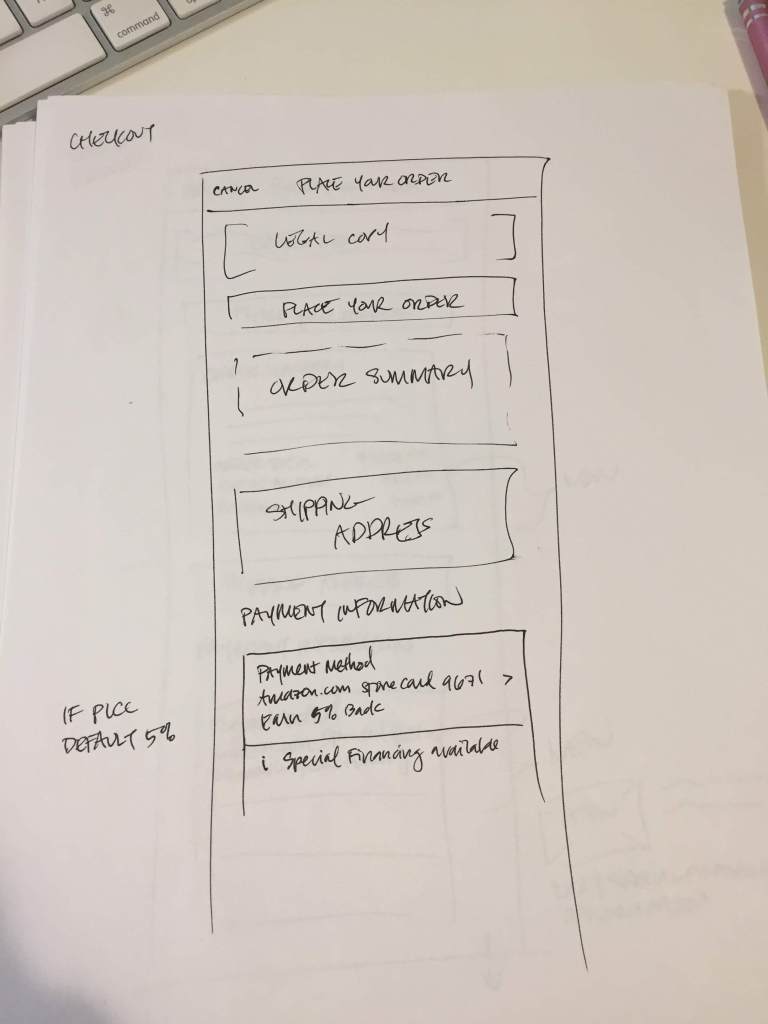

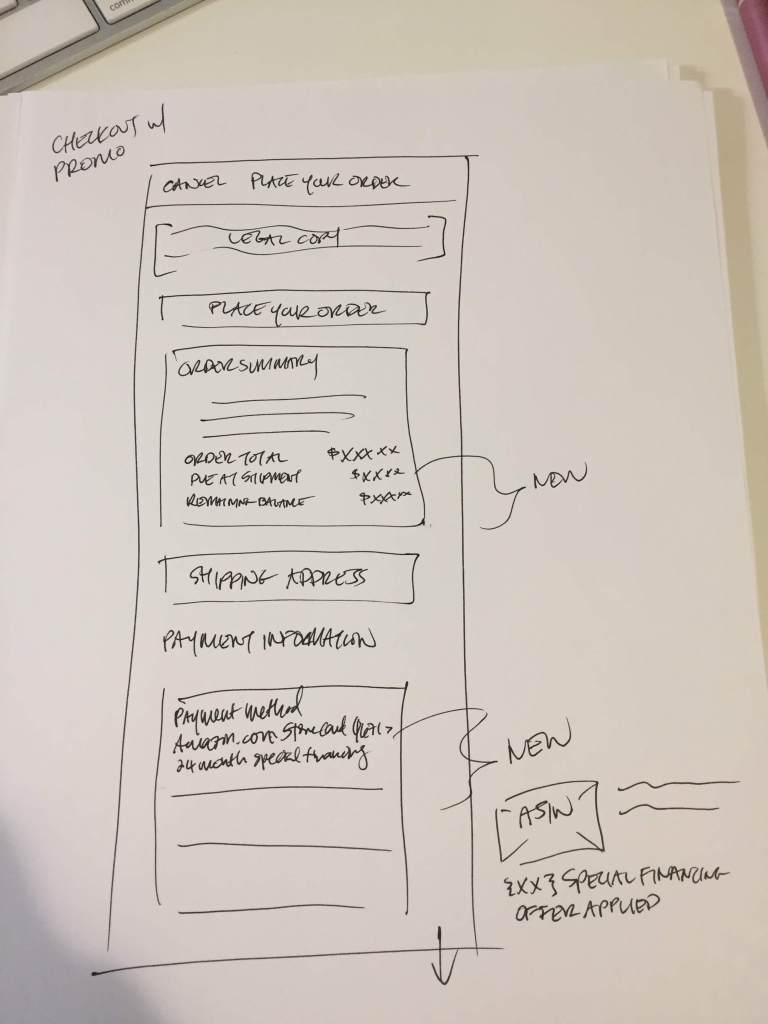

- Sketching/ideation

- High-fidelity design and prototyping

- Cross-team due diligence (design systems, payments, detail page team)

- Usability testing

- Design pattern scaling for credit card based offers

- Legal/compliance approvals

- Dev-ready specifications

- Post-launch iterations

Pre-design research insights (n=15):

- Numbers first: Customers want clear, upfront information about total cost, payment duration, and any interest or fees.

- Details later: Customers prefer to explore the finer details only when they’re ready to decide.

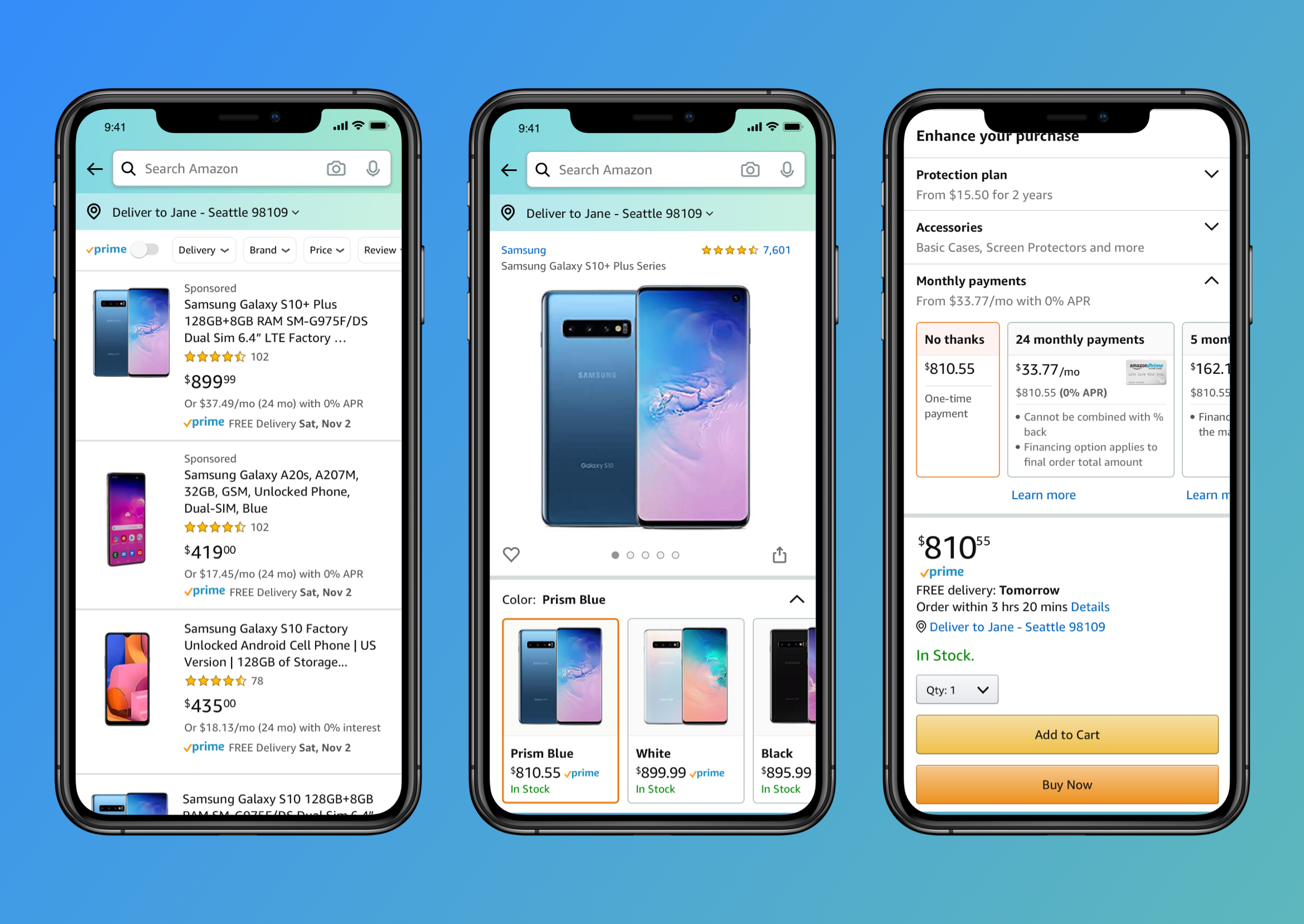

- Price proximity: Customers expect financing information to appear close to the product price.

- Financing feels smart: Customers see financing as a smart way to preserve their available capital.

The design challenge:

Amazon offers a range of financing products, each with different eligibility requirements, terms, and entry points.

Customers were confused by the fragmented presentation, often missing relevant options or misunderstanding the terms. The challenge was to consolidate these disparate experiences while complying with financial regulations, preserving institutional agreements, and maintaining technical feasibility across a global infrastructure.

The solution:

After leading a generative research study that validated the need for a unified payments experience, I spearheaded a major design initiative to surface all eligible financing options upfront through consistent access points and clear, simplified messaging.

Building on these insights, I designed a streamlined ingress point that expanded into a robust, dynamic series of payment selections, with offers tailored to each customer’s eligibility and existing payment methods.

I led cross-functional design efforts in close collaboration with the centralized payments and design systems teams—culminating in the launch of Amazon’s Unified Financing Offers experience.

Testing insights (n=24):

My in-person generative study yielded the following insights:

- Nearly all participants were able to find payment plan options on the product page.

- Some customers assumed the payment plan options were ranked based on popularity or user data, while others thought the order reflected Amazon’s preferences.

- Many customers thought “No thanks” was an appropriate default, but some found it negative, unclear, or felt it discouraged them from choosing a payment plan.

- Customers felt that financing was especially helpful when purchasing a bundle that included electronics, warranties, and accessories.

Results (2 week post-launch snapshot):

- 1.21M opt-ins / 5M impressions (24.2% conversion rate)

- Annualized impact of $19M

- Additional details to be provided during portfolio review

Additional process artifacts: