The Situation

Customers shopping for higher-consideration items struggled to understand whether financing was available, whether they were eligible, and when to select it. Financing options were fragmented across the experience, surfaced inconsistently, and often introduced too late in the journey. Complex terms, unclear eligibility signals, and reliance on checkout-only entry points made it difficult for customers to confidently assess affordability—especially after non-linear or interrupted shopping sessions.

The Strategy

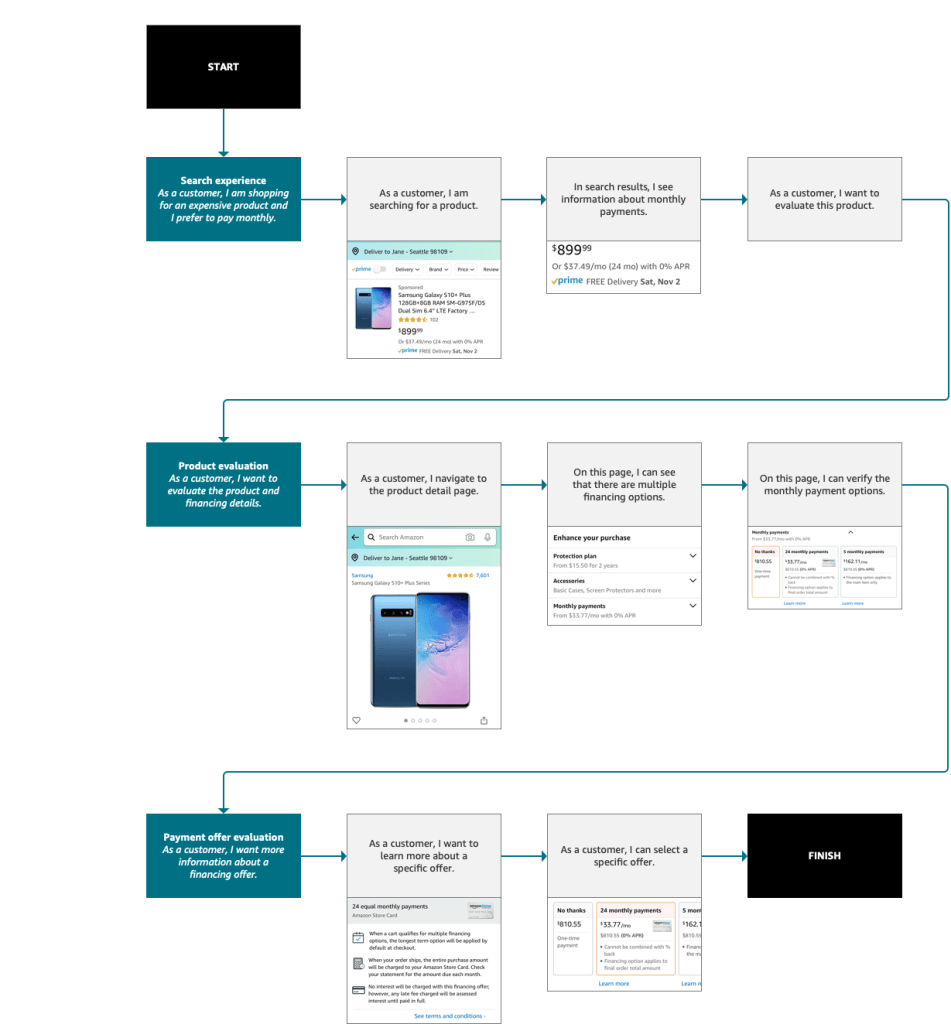

I led a research-driven effort to reframe financing as a clear, upfront part of the shopping decision rather than a last-step surprise. Generative research revealed that customers wanted high-level clarity first—total cost structure, payment duration, and the presence of interest or fees—while reserving detailed terms for later. Customers also expected financing information to appear near the product price and viewed financing as a smart way to manage their available capital when presented transparently.

Based on these insights, I designed a unified entry point that consolidated all eligible financing options into a single, consistent access pattern. This ingress expanded into a dynamic set of payment selections tailored to each customer’s eligibility, existing payment methods, and product configuration. Messaging was intentionally simplified and progressively disclosed to reduce cognitive load while still meeting regulatory and compliance requirements.

To ensure scalability, I partnered closely with payments, design systems, legal/compliance, and multiple product teams to define reusable patterns that could support credit-card-based financing offers across surfaces. Through iterative prototyping, usability testing, and cross-team reviews, the experience balanced customer clarity with technical feasibility and institutional constraints—resulting in Amazon’s Unified Financing Offers framework.

The Result

- Launched a unified Monthly Payments experience surfacing all eligible financing options upfront

- Achieved a 24.2% opt-in rate within two weeks of launch

- Improved discoverability of financing options on product detail pages

- Reduced customer confusion around eligibility and terms through simplified, sequenced messaging

- Established scalable design patterns adopted across credit-based payment experiences